And there are 3 specific reasons:

In this post I explain why this metric is leading you down the wrong path and what you should measure instead.

We’ve always had the intuition that ROAS isn’t 100% reliable.

After all, the ultimate goal of advertising platforms (Meta, Google, etc.) is to generate value for their investors, and their business model depends on you spending more and more on advertising.

The way they achieve this is by inflating ROAS without you realizing it.

In other words, they say they’re generating more money than they’re actually producing.

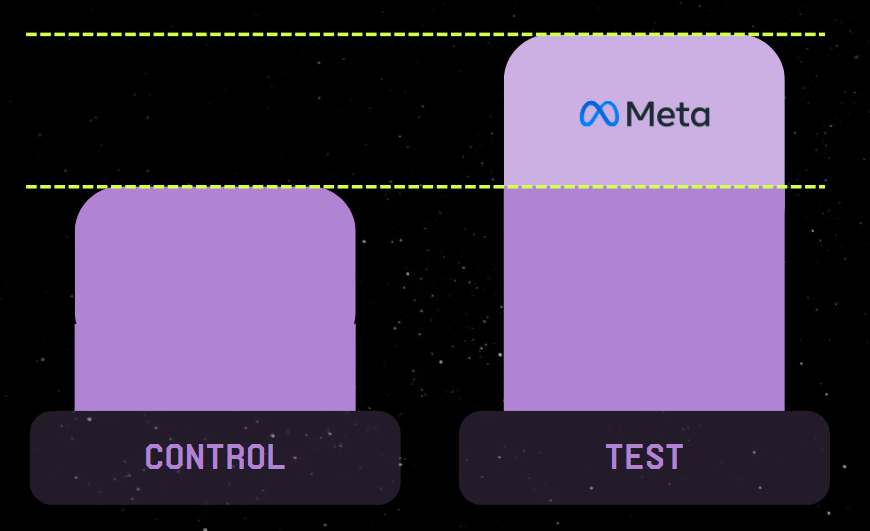

Meta, for example:

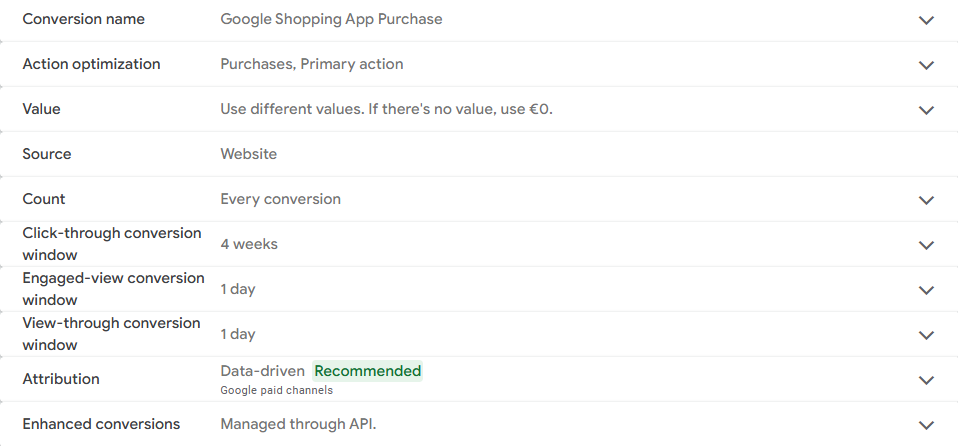

Google is even more aggressive:

Imagine: you searched for your brand, bought 3 weeks later, and Google attributes that sale as a “paid conversion.”

The result: Without constant incrementality tests, you could be overestimating your real ROI by 150-300%. Each platform has different incrementality, each campaign within a platform too, and even the same campaign varies according to creatives and configurations.

The only way to normalize ROAS is by understanding the incrementality factor of each strategy and knowing the iROAS of each one.

If you invest more than $10K/month, implement incrementality tests.

If you invest less, make sure to configure your campaigns as incrementally as possible:

Even if your ROAS were 100% accurate, it’s still an incomplete metric, especially in eCommerce.

Here’s a real example:

Your agency celebrates a 3.0 ROAS (you spend $33 for every $100 billed).

But the math reflects a not-so-optimistic reality:

That 3.0 ROAS is actually a real ROAS of 1.33.

Doesn’t sound so bad, until you remember that fixed costs also exist that you have to cover.

Goodbye profit.

Not very fun, right?

And to complicate matters, each product has different variable costs (production costs, shipping, return rates, etc.) so the Real ROAS calculation varies.

And all this assuming that the ROAS the advertising platform reports is truthful and not inflated, which is usually not the case.

This is where most make the fatal error: optimizing an isolated metric in a complex ecosystem.

In your executive dashboard, besides ROAS you should have:

Paid MER: Total platform revenue (ideally normalized by incrementality) / Advertising investment

This metric will indicate the return on advertising investment across all your sales channels.

aMER: New customer revenue / Advertising investment

It will help you understand the effectiveness of your advertising effort to capture new customers, also considering organic revenue from new customers.

Total MER: Complete revenue / Advertising investment

It will help you understand the impact of all your marketing within your eCommerce, considering both new and recurring customers.

And besides ratios, we have:

Looking only at ROAS means not understanding the complete picture and can lead you to make wrong decisions, over-optimizing this metric at the cost of others or long-term growth.

For example, if the LTV of a new customer increases 70% at 90 days, it might make sense to aim for a low ROAS (even breakeven) because you know the investment recovers quickly. But if you only look at ROAS, you’d never discover this.

That’s why a comprehensive strategy that considers all aspects of your business and a dashboard that lets you see all these metrics in seconds is crucial.

And if you don’t have something like what’s shown below, we can help you 😉

After working with dozens of eCommerce in the $1-10M range, the order of priorities is:

If your eCommerce bills $1-10M and you only measure ROAS, you’re optimizing toward a metric that doesn’t reflect your business reality or its growth potential.

eCommerce businesses that take into account incrementality, variable costs, and other aspects of your business like LTV, don’t just grow faster—they grow more profitably.

At ASTEROI we help eCommerce businesses of $1-10M annually implement measurement systems that truly drive profitable growth.

Ready to stop optimizing false metrics? Let’s coordinate a strategic call.